Is $350k a year really middle class in a big city? Response to Financial Samurai's take

Recently there was an article that Financial Samurai published which outlines why a $350k household income is barely middle class in big cities like San Francisco. This was a pretty controversial article that raised a lot of eyebrows. Both from big-city dwellers as well as middle America.

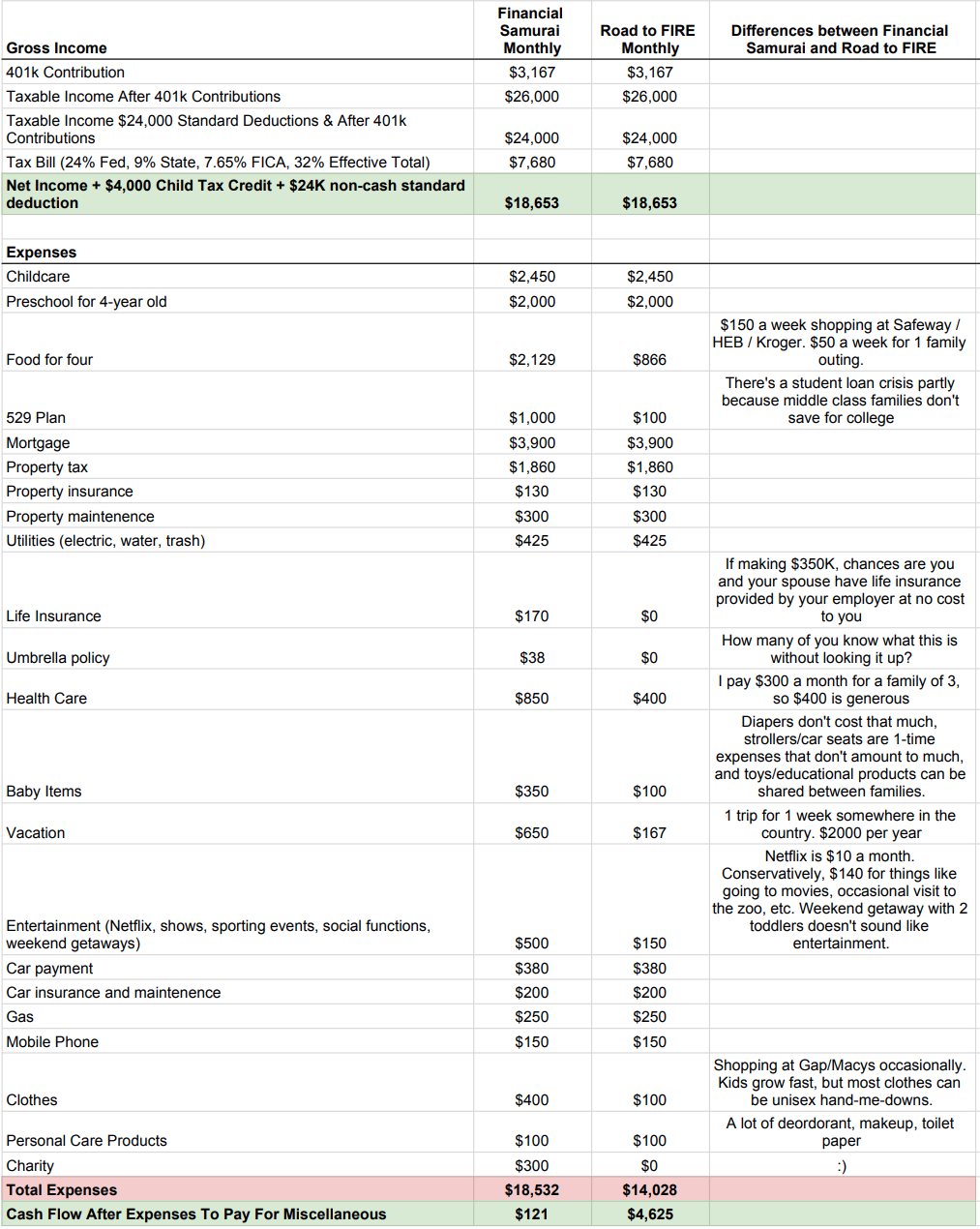

I previously shared my budget for a family of three and it is nowhere near the budget that Financial Samurai laid out for a family of four. In this post, I'll convey my personal take on each line item in his budget. For what it’s worth, I think he highlighted some real sticker-shockers such as housing and childcare. But there’s also plenty of unnecessary things in there that can easily make this family live a comfortable middle-class lifestyle.

Let’s start with what defines a "middle class" family. The definition of a middle-class family in middle-America will certainly differ from that of major cities. But I’ll use my best judgment to come up with something reasonable--that most people can agree to.

(adsbygoogle = window.adsbygoogle || []).push();

Middle-Class Family will have the following properties:

-

15% of income going to retirement

-

3 bed 2 bathroom house for a family of 4

-

Basic childcare from 1-5 years old

-

Public education

-

2 used cars

-

Health insurance

-

1 family vacation a year

-

Grocery shopping at Safeway, Kroger, HEB, etc. Not Whole Foods.

-

Basic entertainment and utilities

-

Shops at Gap, Macy’s, etc. Not Armani, Banana Republic.

NOTE: I'll acknowledge that a slight change in the definition of “middle class” can throw these numbers off in a significant way.

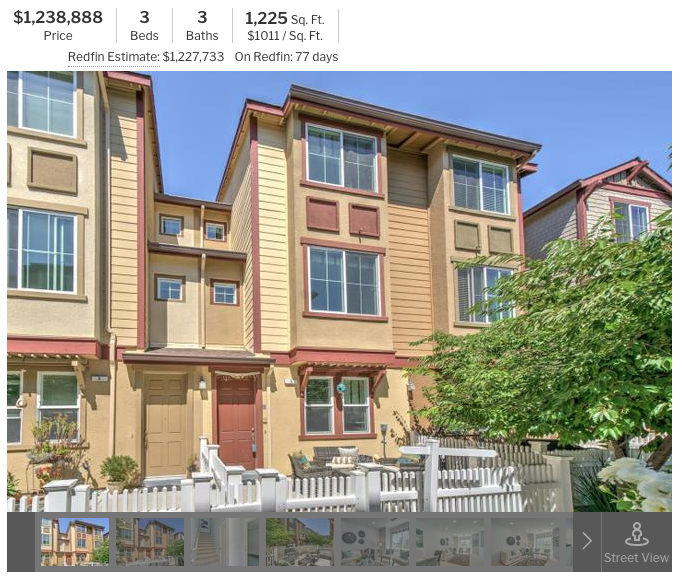

I’ve lived in the Bay Area for almost a decade now and it’s a general consensus that anyone who can buy a single-family home, today, is at least upper, middle-class. For most middle-class folks, it will be difficult to buy a single-family house in the Bay without the help of parents. They would generally aim for townhomes. But for apples to apples comparison, let’s run with the Single Family Home example that Financial Samurai has put forth and see what we end up with...

Comparing with Financial Samurai’s Budget for $350K

Looking at the side by side comparison, you’ll see that we disagree a lot. One yields a budget that is paycheck-to-paycheck and the other leaves you with $4,625 a month. And this is the tightest their budget will be because of childcare. Once their kids are in school, they will have an additional $4,450 a month--a grand total of $9,075 in savings each month! Based on that schedule, in 20 years, this family will have an investment account worth $4M, almost paid for house, and a $1.7M retirement account (assuming a conservative 8% return).

By this point, I’m sure there are folks who live in low-cost-of-living (LCOL) areas who are shocked to hear that $350K a year is not enough to buy mansions and fancy cars. At the same time, folks who are making $350K a year in the Bay Area are confused as to how will they ever be able to save up for a 20% downpayment on a $1.8M property.

The truth is, if you make $350K in Silicon Valley, you are middle class. And the middle class in Silicon Valley do not purchase single-family homes. They purchase townhomes like these (Sunnyvale).

Expense Breakdown

-

Food - $866 a month is $200 a week. $150 should buy a cart full of groceries, and that leaves $50 a week or $100 every two weeks to eat out.

-

College savings - $100 a month is pretty reasonable. Only 66% of families have anything saved up for college. And for those people, only 40% of the funds come in the form of a 529 plan. For those who save (the 66%), the average saving is $18K. Although I don’t have further data, I’m going to guess that the top 10% of American families have significantly more saved for college than the middle 50%.

-

Life Insurance - The Bay Area companies that can pay $350K to a family, will usually have free life insurance covering 3x their annual salary. Although I do recommend term life insurance, middle-class families generally would not pay for a $2M coverage.

(adsbygoogle = window.adsbygoogle || []).push();

-

Umbrella Policy - I can’t imagine anyone in the middle class having heartburn over not having an umbrella policy.

-

Healthcare - $400 bucks is reasonable. I have a family of 3 and have picked the most expensive plan from my employer. Hard to imagine the $350K couple needing to pay more for coverage.

-

Baby Items - Buy used cribs or strollers. Additionally, these are 1-time expenses and can be reused by the 2nd child. Clothes fall into the same category. Finally, disposable diapers cost $50 per 100 Pampers Swaddlers--which my wife tells me is the most expensive. These generally last 2-4 weeks, depending on the age of the baby.

-

Vacation - The average family gets 1 trip for 1 week somewhere in the country. This is a guess. Since the average family makes $60K a year, it’s unlikely that they can spend $7,800 on vacations. A vacation package doesn’t cost more just because one is from Silicon Valley.

-

Entertainment - Entertainment for a family of four is probably Netflix ($10/mo), weekends in the park (free), an occasional visit to the zoo, movies ($50). Also, keep in mind that entertainment does not always cost money. Instead of going to an NBA game, shooting hoops at a local school is free. $150 a month seems much closer to what we spend than $500.

-

Clothes - The middle-class shop at stores like Gap/Macy’s/Target. There is always a sale at one of those stores. When we buy, it’s usually once or twice a year where the total bill does not exceed $400. $100 a month should be sufficient.

-

Charity - I would prioritize hitting financial independence first or at least until childcare isn’t a line-item anymore.

In summary, the only things that should cost more in a big city are housing, childcare, food, and utilities. Clothes, cars, vacations, and baby gear all cost the same whether you live in Silicon Valley or Kentucky. The unfortunate truth is that if you make $350K a year, it’s hard to not keep up with the Jones and even harder to not have lifestyle creep.

Featured

[

](/blog/the-post-financial-independence-life-no-one-talks-about)

The Post-Financial Independence Life No One Talks About

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

I’m Building a FIRE Tool — and I Need Your Input

[

](/blog/management-vs-ic-the-fire-twist-i-didnt-expect)

Management vs IC: The FIRE Twist I Didn’t Expect

2024 Year in Review - Top 6 highlights

[

](/blog/3-things-that-make-fire-hard)

[

](/blog/2023-year-in-review-top-6-highlights)

2023 year in review - top 6 highlights

[

](/blog/5-tips-on-how-to-get-promoted-in-a-big-company)

5 Tips on how to get promoted in a big company

[

](/blog/is-4000000-still-a-good-fire-number)

Is $4,000,000 still a good FIRE number?

[

](/blog/stock-market-is-back-to-near-all-time-highs)

Stock market is back to near all-time highs

[

](/blog/3-ways-i-might-make-money-in-2023)

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments