How I Budget in Silicon Valley

A lot of people in the FIRE (Financial Independence Retire Early) community put a heavy emphasis on having an aggressive savings rate of 50% or more. And one of the best ways to ensure that you are saving enough is through a budgeting program that holds you accountable.

This is not a blog post about minimalism, the Dave Ramsey envelope system, or some strict and elaborate way to budget. I respect those who have the discipline to do that, but I believe most people, including myself, don't. In this blog post, I will share how I budget, my actual budget, and the thought process behind those numbers. Disclaimer: I am living in Silicon Valley, so if the numbers look outrageous, it's because [insert excuse here].

7 steps I use to budget

Step 1 - Calculate my yearly expenses in big categories such as housing, childcare, credit card, travel, car insurance, etc.

A good proxy for this is to take all of your bank statements from the last 6 months and bucket each transaction (e.g. grocery) into a big category (e.g. credit card). I use Mint.com for this type of categorization so I already had a rough idea. Also, whenever I was in doubt I chose the slightly higher number as the budget amount. For example, I budgeted $3,500 a month for housing when we were looking for an apartment to rent in the $3,200 range.

Step 2 - Add a $10,000 buffer to the result of Step 1.

Life happens! Cars break down, water-heater goes out, or unexpected medical expenses can come out of nowhere. Or more likely...the latest iPhone comes out, Dyson vacuum cleaner needs to be replaced, or your back hurts so you buy a $2,200 massage chair. I will not admit to the last three purchases :).

(adsbygoogle = window.adsbygoogle || []).push();

Step 3 - Calculate my yearly take-home pay.

I am paid as a salaried employee so it’s easy to use this tax calculator (California) to compute my take-home pay. Make sure you’re using a tax calculator for your state. Based on my experience it’s been accurate down to the thousandth-dollar. However, if you heavily contribute to a retirement account (e.g. $56K/year into a mega backdoor Roth plan), make sure you manually subtract that from the take-home pay, to avoid double-counting. The tool only allows you to specify up to $24,500. Same for health insurance. If you pay a lot of money to get covered make sure you manually subtract it.

Finally, if you have more complicated income situations (e.g. royalties, rental property income) chances are you have a CPA or your own way of accounting.

Step 4 - Calculate the difference between yearly take-home pay (step #3) and yearly expenses (step #2)--let's call this difference, "investable money."

I will be in 1 of 3 situations:

-

Investable money > 0. I will be in good shape.

-

Investable money = 0. I will live paycheck to paycheck.

-

Investable money < 0. I will be broke or are trending in that direction.

(If this number is less than or equal to zero, then you need to figure out a way to a) make the take-home pay higher and/or b) reduce your expenses.)

Step 5 - Divide the investable amount (step #4) by 52--the number of weeks in a year.

The result is the average amount of money I will have each week to invest.

Step 6 - Setup weekly deposits into my investing accounts by withdrawing from my checking account. Each deposit is the amount computed in Step 5.

I automate the buying of Vanguard’s VTSAX and VIGAX, weekly. I also have another trading account that the rest of the funds get transferred to.

Step 7 - Revisit these steps every year and continuously make sure my checking account is nowhere near negative.

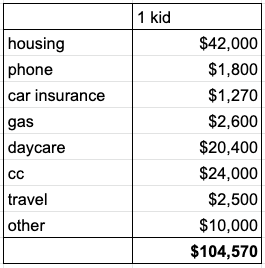

For those curious, Figure 1.1 is my budget for a family of 3, living in Silicon Valley.

[caption id="" align="alignnone" width="265"] Figure 1.1 [/caption]

Figure 1.1 [/caption]

Phone bills, car insurance, gas, travel, and credit-card expenses are more or less the same no matter where you live in the US. However, housing and daycare are expensive in Silicon Valley. And they are the outliers that account for 60% of my budget. Many of you may be wondering why would I live in the Valley if it costs this much. Surprisingly, the biggest reason I am still here, despite the high cost of living, is that this is the best place for me to build wealth. I’ll elaborate in a future blog post about the salary and progression of an engineer in Silicon Valley vs RTP vs Austin vs DC metro.

My Top Learnings through Budgeting:

-

Automation defaults to the “right” actions -- with everything automated, I never stress over whether I should eat out, or travel, or go to a wedding, or buy that new phone. The $10,000 buffer affords me all of my luxuries and I’ve never used more than what I’ve budgeted. I sleep well at night, knowing that even if I made zero additional financial decisions for the year, I will still achieve my financial goals.

-

Lifestyle creep is real, but can be resisted -- as my income and net worth grew, I started to see lifestyle creep--I started to eat out at more expensive restaurants, upgrade computers more often, tip more generously, etc. But budgeting has helped me reset and apply a plateau line that I feel is reasonable. If you want to know if you are experiencing lifestyle creep, then look at your savings rate year over year. If your savings rate is declining, you’re experiencing lifestyle creep!

-

Budgeting forces a growth mindset -- by budgeting every year, it forces me to retrospect on my consumption patterns and career choices. Do I have an income problem or do I have a spending problem? Am I seeing the income growth I expect? Am I seeing the net worth growth I expect? Ultimately, for budgeting, am I seeing my yearly investable money increase year over year?

-

Budgeting has enabled me to forecast my future -- with big-number budgeting, it gives me clarity as to how much I will invest in the stock market. Without it, my projections are mere guesses on top of a series of other assumptions like the stock market appreciation and future tax rates. But budgeting is something I can completely control and have close to 100% confidence on. The fewer variables in the forecast, the better.

-

Start strict, but you can relax as you approach your FIRE number -- after a certain level of net worth and/or income level, the difference between $2100/month vs $3300/month for housing does not move my FIRE date by more than a couple months. Likewise with childcare--$1500/mo vs $2000/mo. That means that as I approach FIRE, the budget can be relaxed. However, the inverse should be true as well. If your net worth is low, you should still be on a very tight budget. Don’t cheat!

Fun Fact: I don’t penny-pinch anymore, but there was a time when I budgeted $25 a week for food--grocery plus eating out. Rice, soy sauce, fried egg, cucumbers, and black pepper make a great meal. And I would only eat out once a week at a Chinese takeout place for $5.25. I did that plan for about a year. I’m not recommending it to everyone, but if you happen to be in a crunch for money, maybe it is worth a try.

If you enjoy this content, please consider following me on my Facebook Page for the latest and subscribing below!

Featured

[

](/blog/the-post-financial-independence-life-no-one-talks-about)

The Post-Financial Independence Life No One Talks About

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

I’m Building a FIRE Tool — and I Need Your Input

[

](/blog/management-vs-ic-the-fire-twist-i-didnt-expect)

Management vs IC: The FIRE Twist I Didn’t Expect

2024 Year in Review - Top 6 highlights

[

](/blog/3-things-that-make-fire-hard)

[

](/blog/2023-year-in-review-top-6-highlights)

2023 year in review - top 6 highlights

[

](/blog/5-tips-on-how-to-get-promoted-in-a-big-company)

5 Tips on how to get promoted in a big company

[

](/blog/is-4000000-still-a-good-fire-number)

Is $4,000,000 still a good FIRE number?

[

](/blog/stock-market-is-back-to-near-all-time-highs)

Stock market is back to near all-time highs

[

](/blog/3-ways-i-might-make-money-in-2023)

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments