8 money things to do before 30 | Part 2

I will share with you the 8 key lessons that I wish I knew straight out of college. I have split them into a 2-part blog series between “defense” and “offense”. Defense is what will keep you from going broke (Part 1). Offense is what will give you the best chance of building massive wealth (Part 2). It’s possible to be wealthy by only playing offense. But if that’s all you do, that wealth will be hard to grow or even preserve over the long term. To build generational wealth, you will need to be good at both offense and defense.

This is Part II of the 2-part series. If you haven’t already, check out Part I, which talks about how I would set up the proper defense to protect against financial downturns. The rest of this article will focus on offense.

Offense

1. Get a job in a career path that pays well

In your early 20s, your net worth is most likely anywhere from negative to barely positive. Even if you were to be the world’s best investor, you won't have much money to build off of. The old adage says money makes money. During these early years, it’s important to realize that your best wealth building tool is going to be your income. While chasing your passion is great, it’s important to find your place within an ever-changing job market that will reward that passion.

(adsbygoogle = window.adsbygoogle || []).push();

Choose a career with at least a decent starting salary ($60K+). I'd avoid fields such as social work and public school teaching, assuming that your goal is to build generational wealth. Also, it's important to choose a field that has a high ceiling and will allow you to progress professionally as well as financially. Something that will allow you to make significantly more in your 30s than in your 20s.

An example of a great career field is software engineering. If you're able to make it into "big tech" such as Google or Facebook your starting compensation could be as high as $200K and can go all the way into the 7-figure range. Imagine being able to invest $100K+ a year in your 20s. You'll be well on your way to FIRE by your early 30s.

Other great fields include nursing, UX designer, data science, and management consulting. And a special call out to the entrepreneurs out there. The ceiling is limitless for you guys, as long as there's a path to profitability.

2. Consistently Invest your extra money

With whatever savings you can muster up from an entry level job, you should start to invest it. Even if it's a small amount, like $200 a month, just start. Over time, challenge yourself to increase the monthly amount to $500, $1K, $5K, $10K, and beyond. This growth mindset is very important to develop. Small wins begets bigger wins begets even bigger wins. Plan for it.

Don't waste that $20K pay raise on an $80K Tesla!

I’d recommend investing in something like FZROX or VTSAX which track the US stock market. As you get comfortable with the fluctuations of the stock market, I'd then recommend looking into dividend growth investing (DGI). This type of strategy is great if you plan to be hands-on and retire early.

3. Focus on building the skills to excel professionally

In most high paying fields, your compensation is a function of skills and accomplishments, not tenure. I’ve seen many young professionals stagnate early in their careers--even those who come from prestigious universities like MIT and Stanford. They are either satisfied with their prestigious job or they are used to being the smartest person in the room. The pattern that I’ve seen is that they can become complacent because school is no longer pushing them. The transition from paying $60K a year for school to making $100K+ a year at a job can be so satisfying that it zaps the hunger out of them. Couple that with establishing a post-university social circle, it can be easy to lose focus on career progression.

I’m not advocating for 16-hour work days. I am advocating for 12-hour work days though :). Put in the work now, so that you can enjoy time with your spouse and kids later; and so that you can make 2x, 3x, or 10x later.

It’s also important to focus on acquiring and honing the skills that actually matter. Being the world's fastest typer is cool, but getting the message across with fewer words is more valuable.

4. Continuously expand your knowledge on money

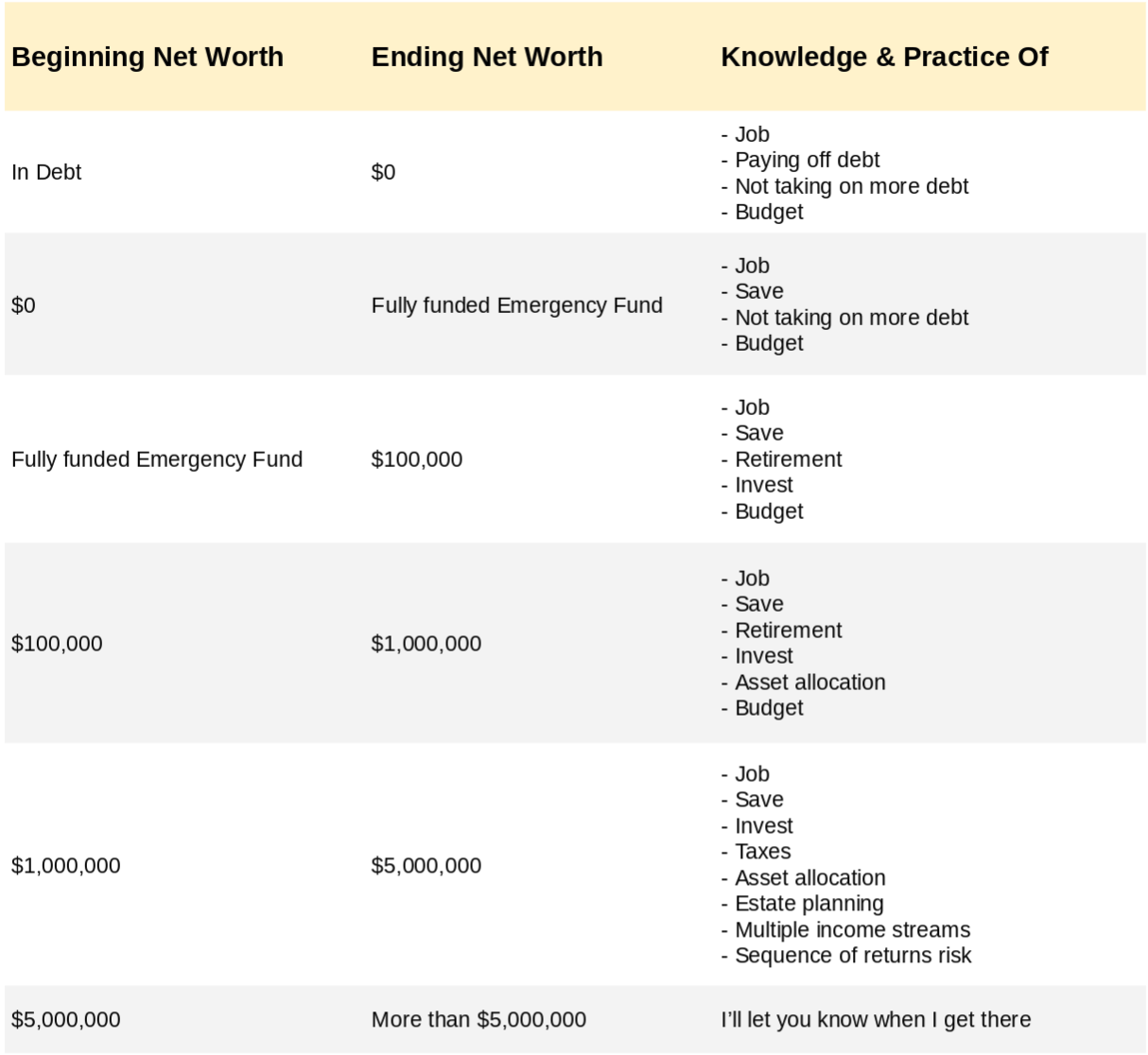

As you climb the net worth ladder, you should continue to expand your financial knowledge. The things you did that got you from $0 to $50,000 in net worth will most likely not get you from $50,000 to $500,000. And the things you did that got from you $50,000 to $500,000 will most likely not get you from $500,000 to $5,000,000. Here’s a rough outline of what people should learn/care about as they climb the net worth ladder.

The best thing to do in your 20s is to get into a growth mindset and stay in it for as long as possible!

(adsbygoogle = window.adsbygoogle || []).push();

As you exit your 20s, these 4 offensive moves you will set you up for success in your 30s. When paired with strong defense (see Part I), you can easily be a multi-millionaire by 65 years old. And, you would have changed your family tree in just one generation!

Featured

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

Oct 26, 2025

I’m Building a FIRE Tool — and I Need Your Input

Oct 26, 2025

Oct 26, 2025

[

](/blog/10-ways-to-succeed-as-an-employee-part-iii-of-iii)

Aug 22, 2022

10 ways to succeed as an employee (Part III of III)

Aug 22, 2022

Aug 22, 2022

[

](/blog/5-reasons-why-its-hard-to-retire-early-after-reaching-financial-independence)

Jan 21, 2022

5 reasons why it’s hard to retire early after reaching Financial Independence

Jan 21, 2022

Jan 21, 2022

[

](/blog/road-to-1000000-portfolio-series-part-1)

Apr 2, 2021

Road to $1,000,000 portfolio (series) - Part 1

Apr 2, 2021

Apr 2, 2021

[

](/blog/my-77000-experiment-portfolio-year-end-2020-update)

Jan 4, 2021

My $77,000 experiment portfolio -- year end 2020 update

Jan 4, 2021

Jan 4, 2021

[

](/blog/road-to-10-million-retire-by-35-and-become-a-deca-millionaire-by-50)

Nov 16, 2020

Road to $10 million - Retire by 35 and become a deca-millionaire by 50

Nov 16, 2020

Nov 16, 2020

[

](/blog/my-77000-experiment-portfolio-june-update)

Jun 5, 2020

My $77,000 experiment portfolio -- June update

Jun 5, 2020

Jun 5, 2020

[

](/blog/how-am-i-navigating-covid-19)

Apr 4, 2020

Apr 4, 2020

Apr 4, 2020

[

](/blog/average-net-worth-by-age)

Dec 21, 2019

Dec 21, 2019

Dec 21, 2019

[

](/blog/how-engineers-can-fire-in-15-years-and-have-4000000-in-net-worth)

Oct 31, 2019

How engineers can FIRE in 15 years and have $4,000,000 in net worth

Oct 31, 2019

Oct 31, 2019

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments