The $77,000 Experiment -- My Dividend Aristocrats Portfolio

The time has come. This is the blog post series where the rubber meets the road, where the pen meets the paper, and where my $77,000 meets its Dividend Aristocrat friends. In one of my previous posts, I had written about why I think Dividend Aristocrats is a great alternative to real estate, and in general, provides a great way of increasing one’s monthly cash flow.

In this post:

-

I will share how I plan to invest $77,000 in 2020

-

I will show exactly what I invest in, including my M1 Finance pie

-

I will share my thought process for choosing my Dividend Aristocrat (mostly) stocks

My plan to invest $77,000 in 2020

-

Buy $25,000 worth of dividend aristocrat stocks on the first trading day in 2020 (i.e. frontload).

-

Auto-invest an additional $1,000 each week (i.e. dollar-cost average over 52 weeks). Totaling, $26,000 for the first week ($25K initial deposit + $1K for the week).

-

Comes out to be a grand total of $77,000 invested for 2020 ($25K + $1K x 52 weeks)

I will post monthly updates and share exactly the gains/losses and dividend payouts. So subscribe and stay tuned!

(adsbygoogle = window.adsbygoogle || []).push();

Goals

-

Increase quarterly cash flow

-

Dividend yield that beats VTI (~1.7%)

-

Portfolio value appreciates similarly to the S&P 500 Index (VOO) and US Total Stock Market Index (VTI)

Caveat

-

Nasdaq, Dow Jones Industry Average, and S&P 500 are at historic all-time highs

-

If there is a major pullback in stocks, I will contribute *more* than $1,000 a week.

What am I investing in (January 2020)?

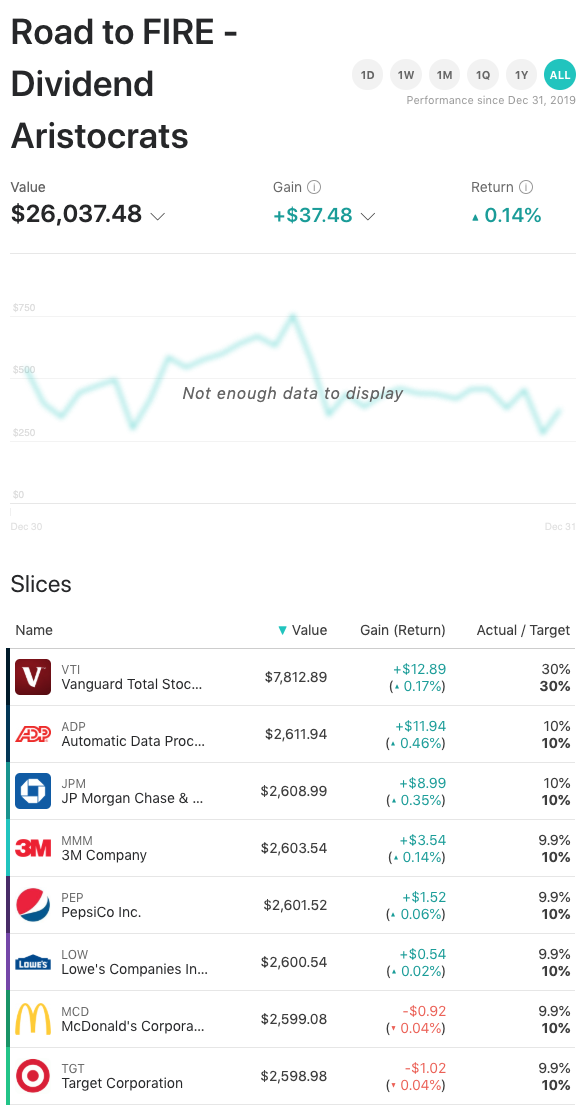

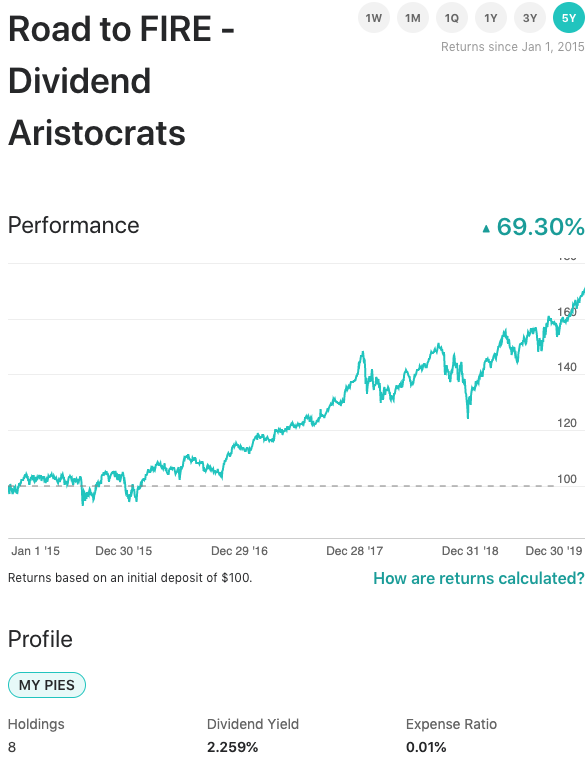

You can view the full portfolio here. The portfolio is on pace to have a 2.253% dividend yield. And based on the stocks that I’ve currently chosen, it has appreciated over 68% in the last 5 years. I’m not banking on another 68% run over the next 5 years, but for comparison sake, the US Stock Market has appreciated 54% during that same period.

M1 Finance performance overview of my pie:

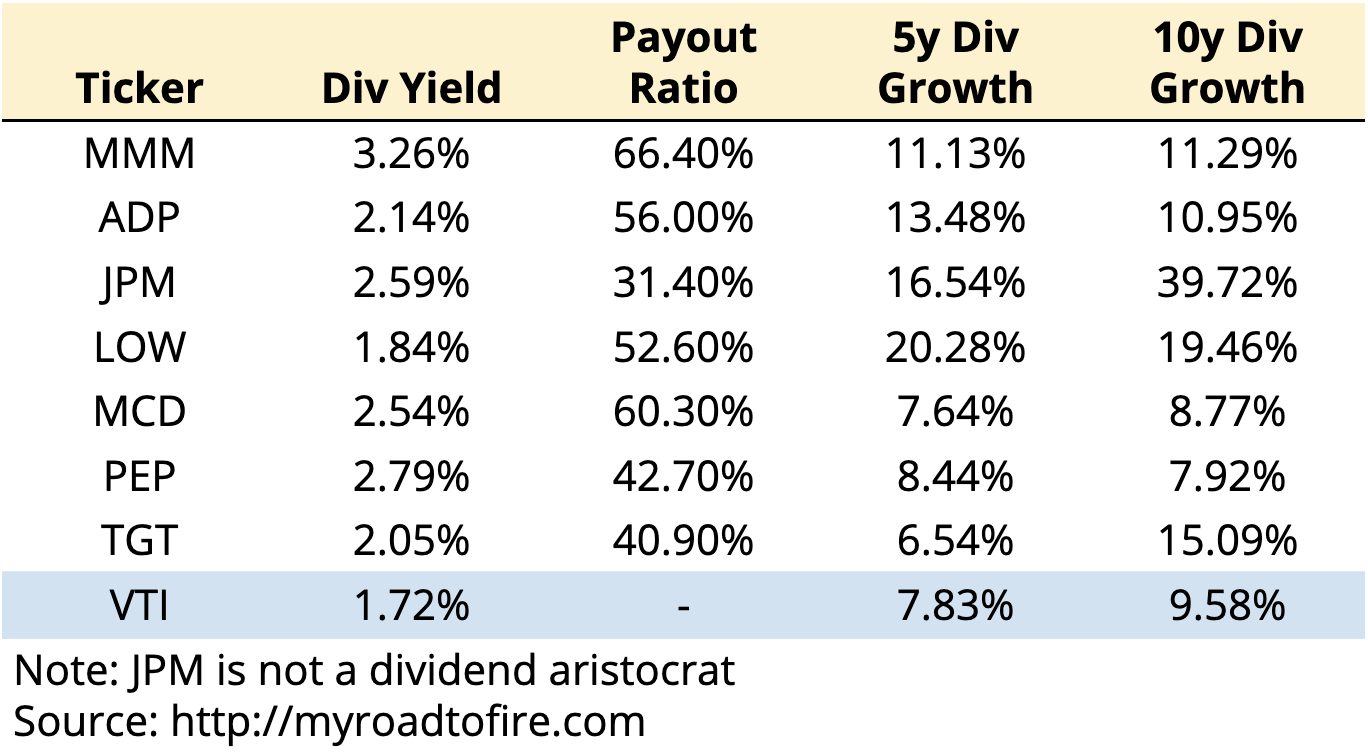

Factors considered when choosing stocks

When choosing the stocks in my M1 Finance portfolio I looked at 4 dimensions. These dimensions paint the general picture of how “healthy” the dividend is and its potential growth in the future.

Factor #1 - Dividend Yield

This is the percentage of a stock’s value that is sold each year and paid to me as a shareholder. Since one of my primary goals is to generate higher cash flow than what VTI gives me, the dividend yield for the stocks I’m looking for needs to be at least 1.7%.

(adsbygoogle = window.adsbygoogle || []).push();

Factor #2 - Payout Ratio

This is the proportion of earnings paid out as dividends to shareholders. For example, if McDonald’s net income was $10, and they paid $6 in dividend payouts, the payout ratio is 60%. In other words, total dividends divided by net income. The higher the ratio, the less room the company has to increase their dividend payout. For this reason, I try to look at companies whose payout ratio is less than 50%.

Factor #3 - 5-year dividend growth

This is the running 5-year growth of a stock’s dividend. For example, if a stock paid $1.00 in 2017, $1.10 in 2018, and then $1.21 in 2019, the 3-year dividend growth is said to be 10%.

Factor #4 - 10-year dividend growth

Same as 5-year, but for a 10-year horizon, including the 2009 recession.

Why M1 Finance?

You’re probably wondering why I chose to go with M1 Finance instead of something more mainstream like a Charles Schwab. The main reason is because M1 Finance makes it easy to rebalance a portfolio to a specified allocation. For my pie, I’ve decided that no individual stock will be more than 10% of the portfolio. And since I have picked 7 individual stocks, 70% is allocated towards those stocks, leaving 30% invested in VTI. As I find more opportunities for additional individual stocks, this allocation will change. And M1 Finance makes this easy.

The other reason why I chose M1 Finance is because I already have a Fidelity, Charles Schwab, Vanguard, and TD Ameritrade account. For the purposes of separating out my personal finances from the Road to FIRE “portfolio”, I figure it is best to start with a clean account. This way, I can safely take screenshots and be 100% transparent with you.

Let’s get this party started!

How do you invest? Let me know by filling out a quick survey.

Featured

[

](/blog/the-post-financial-independence-life-no-one-talks-about)

The Post-Financial Independence Life No One Talks About

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

I’m Building a FIRE Tool — and I Need Your Input

[

](/blog/management-vs-ic-the-fire-twist-i-didnt-expect)

Management vs IC: The FIRE Twist I Didn’t Expect

2024 Year in Review - Top 6 highlights

[

](/blog/3-things-that-make-fire-hard)

investing, fire, money, retirement

investing, fire, money, retirement

investing, fire, money, retirement

[

](/blog/2023-year-in-review-top-6-highlights)

2023 year in review - top 6 highlights

[

](/blog/5-tips-on-how-to-get-promoted-in-a-big-company)

5 Tips on how to get promoted in a big company

[

](/blog/is-4000000-still-a-good-fire-number)

Is $4,000,000 still a good FIRE number?

[

](/blog/stock-market-is-back-to-near-all-time-highs)

Stock market is back to near all-time highs

[

](/blog/3-ways-i-might-make-money-in-2023)

money, fire, stocks, real estate

3 Ways I Might make money in 2023

money, fire, stocks, real estate

money, fire, stocks, real estate

(adsbygoogle = window.adsbygoogle || []).push();

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments