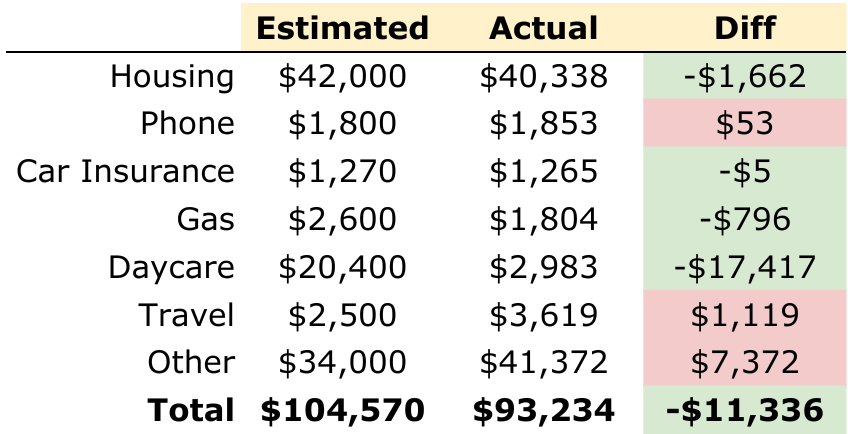

How much did I spend in 2019

Now that 2019 has come to an end, I took some time to review my finances. The week between Christmas and New Year is my favorite week of the year. Other than the obvious reasons of getting to spend time with family/friends and getting a breather from work, I get to spend time reflecting and reviewing the previous 51 weeks. And I often learn something that significantly impacts how I operate in the following year.

I spent $93,234.13 in 2019, which is the most I’ve ever spent in a single year (if car purchases aren’t included).

Transactions grouped by category

[caption id="" align="alignnone" width="247"] Figure 1 [/caption]

Figure 1 [/caption]

Distribution of Number of Transactions:

-

3.1% (41) of transactions were $500+

-

8.3% (109) of transactions were between $100-$500

-

88.5% (1156) of transactions were less than $100

Distribution of Transaction Value:

-

Transactions above $500 accounted for $56,966.14 (61.1%)

-

Transactions between $100-$500 accounted for $18,290.92 (19.6%)

-

Transactions less than $500 accounted for $17,977.07 (19.2%)

(adsbygoogle = window.adsbygoogle || []).push();

Fun facts:

-

1306 transactions for 2019 = 3.57 transactions per day

-

We spent $10,996.91 on eating! This includes groceries, sit-down restaurants, fast-food restaurants, dessert, coffee, boba tea, etc.

-

Apparently, we really like Happy Lemon. We spent $190.42 on Happy Lemon boba tea!

-

My wife recently started a cooking YouTube channel which ate up a decent amount of the “Grocery” category. It’s unclear how much was for the cooking channel and how much was for personal. We haven’t incorporated...which, after looking at this, we should.

-

I did not know that MRIs would cost me thousands of dollars! The medical bills this year were especially high this year because of 2 MRIs, 2 root canals, and about a dozen chiropractor visits.

-

Security deposits to rent a townhome in Silicon Valley is expensive! We recently moved and had to pay $8,100. I was conflicted about including this in the “spend” section because we will get it back at some point. However, I figured that I’d err on the side of transparency.

-

“Entertainment” is not much of a thing for my family. Based on this summary, it looks like eating is our entertainment.

-

My kid went to daycare for only part of the year, which is why the “daycare” category was so low. If it were a full year, the “daycare” category will be up to ~$22K.

-

Finally, wow…almost $9,000 on Amazon. Good thing I own their stock.

(adsbygoogle = window.adsbygoogle || []).push();

How does this compare to my budget at the beginning of the year?

I previously posted how I budget as an engineer and family of 3 living in Silicon Valley. TL;DR is that I look at the big categories, estimate how much I need, and automate the rest of the money out of my checking account so that I wouldn’t be able to spend it. I don’t go very in-depth with the categorization of each of my budget line items. Let’s see how I fared:

Where I did poorly

Travel - it may look like we overspent on the “Travel” category, but we actually foot the bill for several families’ AirBnB. We got reimbursed, but I couldn’t figure out exactly which deposit mapped to the AirBnB line item, so I left it out. Or maybe I need to go chase down some family members...kidding.

Other - Specifically, “Medical” + “Housing Security Deposit” accounted for $13,617.40. I did not expect that I’d spend that much on medical expenses this year. I’ve been trying almost everything to improve my back pain, including a chiropractor, physical therapy, along with a couple of very expensive MRIs. Also, we recently moved into a better place, but the required deposit was $8,100.

Where I did well

Daycare - we got lucky and underspent on daycare because my spouse stayed at home for most of the year. However, now that we are a dual-income family, we are actually building wealth faster now.

Everything else - pretty happy with everything else!

(adsbygoogle = window.adsbygoogle || []).push();

Conclusion

Overall, I’m satisfied with how the year went. I budgeted for a very generous $104,570 and ended up spending $93,234. We never felt like we were overspending, or even close to it because our checking account never dropped below my threshold for “danger.” I’m glad that the movement of my money is automated and that I don’t need to worry about having a strict budget. All I need to worry about is not running out of money in my checking account!

NOTE: For those interested in how I was able to export and compute the categorization seen in Figure 1, feel free to join our Slack channel. Then we can nerd out together.

Featured

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

I’m Building a FIRE Tool — and I Need Your Input

[

](/blog/10-ways-to-succeed-as-an-employee-part-iii-of-iii)

10 ways to succeed as an employee (Part III of III)

[

](/blog/5-reasons-why-its-hard-to-retire-early-after-reaching-financial-independence)

5 reasons why it’s hard to retire early after reaching Financial Independence

[

](/blog/road-to-1000000-portfolio-series-part-1)

dividends, investing, portfolio, fire

Road to $1,000,000 portfolio (series) - Part 1

dividends, investing, portfolio, fire

dividends, investing, portfolio, fire

[

](/blog/my-77000-experiment-portfolio-year-end-2020-update)

dividends, portfolio, fire, stocks

My $77,000 experiment portfolio -- year end 2020 update

dividends, portfolio, fire, stocks

dividends, portfolio, fire, stocks

[

](/blog/road-to-10-million-retire-by-35-and-become-a-deca-millionaire-by-50)

Road to $10 million - Retire by 35 and become a deca-millionaire by 50

[

](/blog/my-77000-experiment-portfolio-june-update)

fire, portfolio, stocks, covid19

My $77,000 experiment portfolio -- June update

fire, portfolio, stocks, covid19

fire, portfolio, stocks, covid19

[

](/blog/how-am-i-navigating-covid-19)

[

](/blog/average-net-worth-by-age)

[

](/blog/how-engineers-can-fire-in-15-years-and-have-4000000-in-net-worth)

fire, tech, engineering, silicon valley

How engineers can FIRE in 15 years and have $4,000,000 in net worth

fire, tech, engineering, silicon valley

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments