Get paid more every year -- Retiring with Dividend Aristocrats

As I prepare to go into early retirement, I am slowly changing my asset allocation to produce a higher cash flow. There are multiple good ways to do this. The most popular method is to own rental properties. But my preferred method is to own Dividend Aristocrats.

ATTN: Scroll to the end for an announcement

What is a Dividend Aristocrat?

A Dividend Aristocrat is a dividend-paying stock that has increased its dividend payout for at least 25 consecutive years. There are other qualifiers as well, but for the purposes of this post, I'll focus on the dividend payout characteristic. Examples of a dividend aristocrat stock are McDonald's, Target, Walmart, Johnson & Johnson. And as of 2019, there are 57 Dividend Aristocrats.

They increase their dividends, so what?

"So what?" I hate it when people use that phrase!

There are two angles to look at why an increasing dividend is essential.

(adsbygoogle = window.adsbygoogle || []).push();

#1 Cash flow perspective

When people have entered retirement, having predictable income streams is more important than having the chance of greater wealth. The amount of cash flow that the investment portfolio yields should not decrease, especially during recessions when it will be harder to re-enter the workforce.

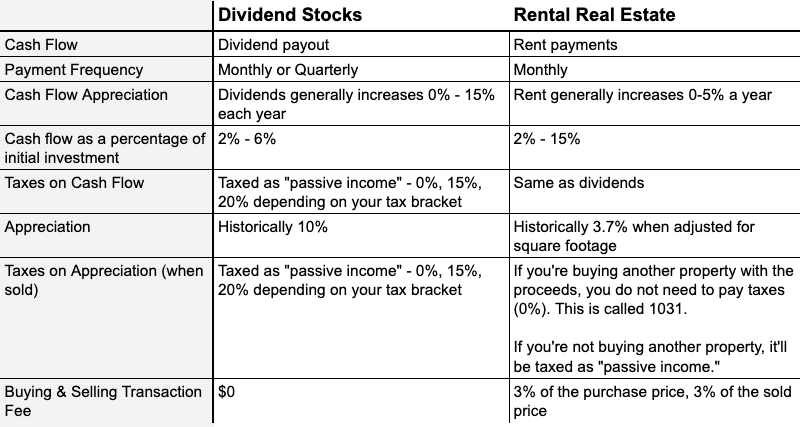

For that reason, real estate is very attractive. When was the last time your rent went down? Here’s a table to compare Dividend Aristocrats to rental real estate:

(adsbygoogle = window.adsbygoogle || []).push();

(adsbygoogle = window.adsbygoogle || []).push();

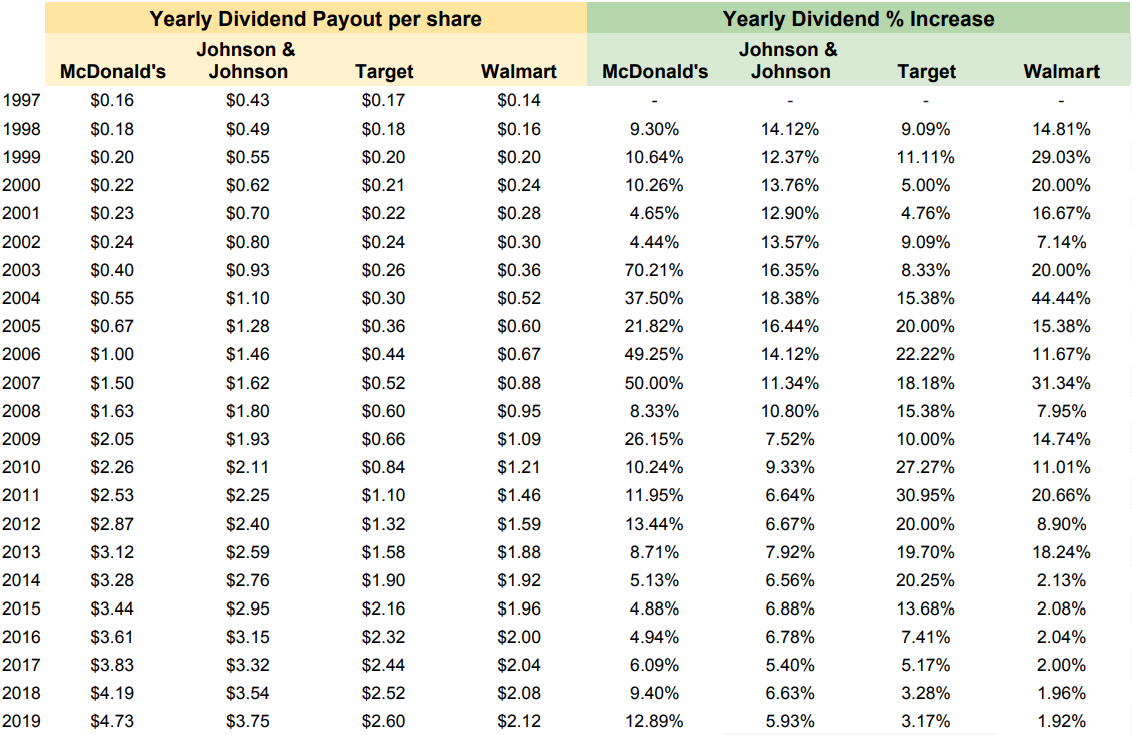

And here is the dividend payout history for some of the Dividend Aristocrat stocks:

#2 Asset appreciation perspective

Based on historical data, Dividend Aristocrats:

-

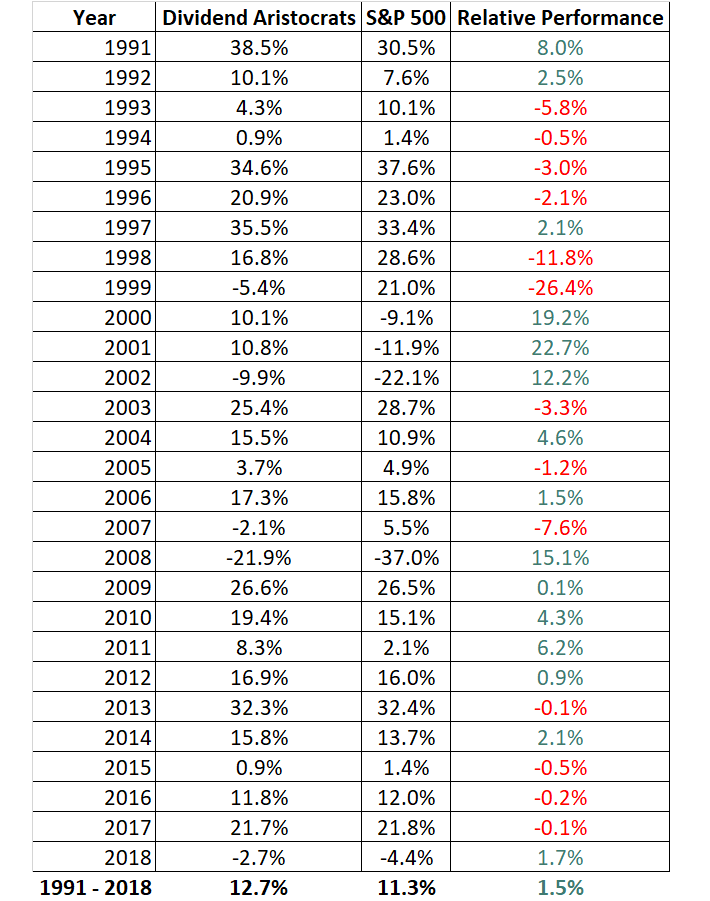

Have outperformed the S&P 500

-

Provide greater stability during recessions. By definition, all of today's Dividend Aristocrats increased their dividends even during the Dotcom bubble and the Great Recession.

[caption id="" align="alignnone" width="710"] Source: Ploutos [/caption]

Source: Ploutos [/caption]

ANNOUNCEMENT

Several people have reached out to me to understand what I invest in and what my rate of returns are. After thinking hard about how best to serve these types of requests and to educate at a larger scale, I've decided to open a brand new M1 Finance account which I'll initially seed with $25,000. And each week, I'll deposit an additional $1,000. I'll be posting periodic updates and commentary on the account...so please subscribe and stay tuned!

(adsbygoogle = window.adsbygoogle || []).push();

Featured

[

](/blog/the-post-financial-independence-life-no-one-talks-about)

The Post-Financial Independence Life No One Talks About

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

I’m Building a FIRE Tool — and I Need Your Input

[

](/blog/management-vs-ic-the-fire-twist-i-didnt-expect)

Management vs IC: The FIRE Twist I Didn’t Expect

2024 Year in Review - Top 6 highlights

[

](/blog/3-things-that-make-fire-hard)

investing, fire, money, retirement

investing, fire, money, retirement

investing, fire, money, retirement

[

](/blog/2023-year-in-review-top-6-highlights)

2023 year in review - top 6 highlights

[

](/blog/5-tips-on-how-to-get-promoted-in-a-big-company)

5 Tips on how to get promoted in a big company

[

](/blog/is-4000000-still-a-good-fire-number)

Is $4,000,000 still a good FIRE number?

[

](/blog/stock-market-is-back-to-near-all-time-highs)

Stock market is back to near all-time highs

[

](/blog/3-ways-i-might-make-money-in-2023)

money, fire, stocks, real estate

3 Ways I Might make money in 2023

money, fire, stocks, real estate

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments